How did Cryptocurrency begin and why are government skeptical about it?

ECONOMIC HISTORY

How did first Cryptocurrency begin and why are government skeptical about it?

What is the quickest get rich method in today’s world if your parents are not already rich with inheritance of millions

BUY CRYPTOCURRENCY.

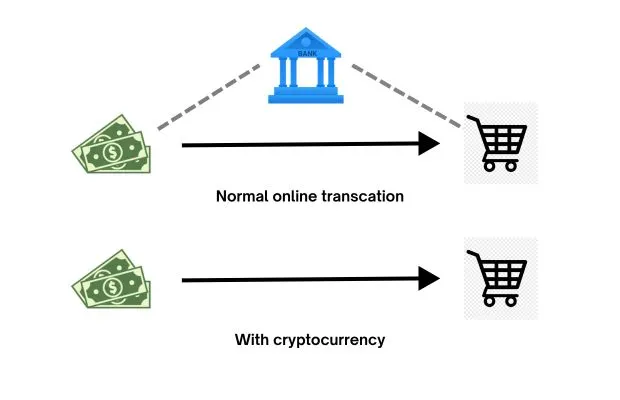

Bitcoin was first launched in 2009 by Satoshi Nakamoto whose basic idea was to start a peer-to-peer without being dependent on a third party. He noticed that virtual money is invisible, other than trusting the third-party (banks, government, payment companies) we have no way to directly buy or sell to anything.

To remove the dependence of third party and protect a person’s privacy, the idea of using cryptocurrency was birthed.

What is currency? A currency is ‘the state of being believed, accepted or used by many people’, according to Oxford Dictionary. If using cash is physical currency without third-party and crypto is a virtual currency without relying on an external organization.

Crypto is transparent and decentralized. How crypto can be both transparent yet protect privacy? It stores the data of every transaction made in ‘blockchain’ (a ledger) across many computers in the network and ‘mining’ is the way to validate this transaction which would release new coins in the circulation. In simple words, an individual can mint coins by verifying the transactions of other crypto-owners and operating the network without relying on third agency.

The privacy of owner is insured as the crypto network uses transaction ID instead of original name but the concern arises because it also leaves the risk of ID being exposed. Once the Transaction ID is connected with the person, it is easy to violate the privacy.

Despite having no value of its own, cash is valuable because they are redeemable and sometimes hold the words “I promise to pay the bearer”, which is backed by the government or commercial banks maintaining people’s faith. Therefore, third-party not only makes the transaction but is also a way to regulate the money.

Many countries have directly banned or not legalized cryptocurrencies because of reason it exits, because it has no regulatory body. The idea of crypto is to act like a currency in free market but without a regulatory body it is much harder to trace cryptocurrency crimes.

With the rapid technology advancement and crypto fully dependent on technology, the chances of money laundering rise greatly and the market can be manipulated.

The idea of cryptocurrency is new and still being tested, therefore many countries are still sceptical about it. A regulatory body needs to be set up to prevent scams and hording.

THE EVOLUTION OF BITCOIN

Bitcoin has no value of its own and it is not a security as it is not based on valuation or give dividends. Though it is also not exactly a commodity like gold, silver but both are ‘mined’ and now cryptocurrency is regulated by Commodity Futures Trading Commission (CFTC) in USA.

Bitcoin (BTC) is the first type of cryptocurrency and the most famous among all. There are only 21 million cryptocurrencies reduced by 50% every four year, for example-A person holds 20 BTC, after four years it will reduced to 10 BTC but each BTC will become more valuable. Considering this, the last Bitcoin will be earned in 2140.

The Cryptocurrency was not used by many when it began. It was used The in commercial transaction for the first time in 2010 when someone exchanged 10,000 bitcoins for two pizzas from Papa John’s which was worth $41. Three years later, 2013 was when Bitcoin hit 1,000$ for the first time through it dropped soon.

As of March 2025, the cryptocurrency market is $2.96 trillion dollars. The craze is raging and the market is showing bubble like characteristics. Whether the last or not all depends on the future development and how the governments around the world react to the market.

Citation

Sharma, D. Pant, D. & Kumar, A. (April 2023). Cryptocurrency: An Overview of its History, Technology and Future Prospects. International Journal of Advanced Research in Science, Communication and Technology (IJARSCT)

Burgt, V. (April 2018). Making Sense of Bitcoin Price Levels. Federal Reserve Bank of San Francisco

Li, T. Li, W & Li, S. (2021). Analysis of Bitcoin Development and Investment Value. Atlantic Press

Murtagh, Elaine. (2023). The Dark Currency: an analysis of the relationship between Dark Market activity and Bitcoin returns. 10.13140/RG.2.2.22720.85767.